By: Odigbo Ugochukwu Sandra [Miss] Esq.

On the 17th of August, 2020, Mr. David Hundeyin released an article titled “David Hundeyin’s State Theft, Cryonism and Civil Rights Violations: Inside the Hidden Horrors of the CAMA 2020 Bill”. The article was an analysis expressing the writer’s reservations about the Companies and Allied Matters Act, 2020 which was signed into law by President Muhammadu Buhari on the 7th of August, 2020. Having read the very well written article, I recognize and applaud the writer’s need to call out the Nigerian government where he feels they have fallen short of their mandate.

However, there is a glaring shortsightedness in the analysis in the article. I believe this myopia stems from the fact that the writer is not a lawyer and may not have the wherewithal to interpret matters of the law as a lawyer can. Certain seemingly straightforward and simple words mean so much in the legal parlance. Also, the writer, in some cases, failed to present a holistic view of entire provisions and limited himself to the analysis of singular sections which, when read alone, do not present the full intent of the provision.

The article by Mr. Hundeyin raised a lot of social media attention which caused an uproar as there was a gaping absence of a devil’s advocate point of view. A few lawyers attempted to respond to the allegations in the article, but there are still a lot of unanswered questions. Thus, this article is aimed at explaining to the average Nigerian in the most layman terms the actual intendments of the sections highlighted in Mr Hundeyin’s article.

CAMA 2020: NGO Bill in Disguise?

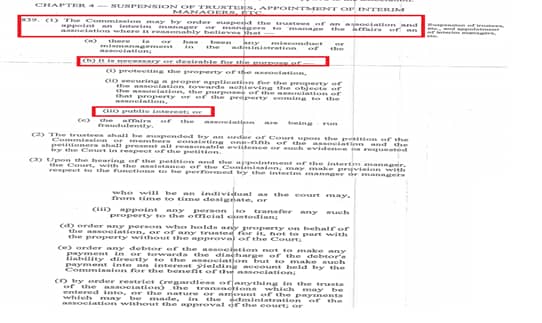

The interpretation ascribed to the above marked clauses is as follows:

“The commission may remove and replace the trustees of a CSO if it determines that it is in “the public interest” to do so – in its sole opinion and based on criteria nobody else has access to.”

This interpretation is wrong. Let’s take a wholesome look and attempt a more applicable interpretation. This section gives the CAC the power to suspend and appoint trustees where it appears to the commission amongst other grounds, that it is necessary for the purpose of securing public interest. This provision appears draconian at first glance, does it not?

But taking a closer look, it is immediately followed by directions to the Court as regards its powers to make the order upon which this suspension and appointment may be made. First, an order must be obtained from the Court. The Act is silent as to whether the Order is to be obtained by a motion on notice or a motion exparte. For non-lawyers, a motion on notice requires that the other party be notified and appear in Court where the Court will then hear both sides and decide whether or not to grant the motion; while a motion exparte is one where the Court grants the order without recourse or notification to the other party.

A motion exparte is typically granted in two instances:

- Where a law specifically provides that application be by motion exparte

- Where there is grave urgency and the rights of the applicant may be irrevocably affected if the motion is not granted.

See the Federal High Court Rules at Rule 26; Itama Vs Osaro-Lai (2000) 6 NWLR (pt 661) 551; Kotoye Vs CBN (1989) 419

Thus, where a law simply says ‘motion’, it refers to a motion on notice.

Applying this to the provision above, it means that the CAC may suspend and appoint trustees ony7l after approaching the Court for an Order by way of a motion on notice. This means that the trustee who is to be the subject matter of the order will appear before the same court with his own case. The Court will then decide based on the preponderance of evidence, whether to grant the Order or not. The CAC will not wake and suspend random trustees as the writer stated. Far from it. The CAMA provides a clear and common procedure which must be followed for any such order to be valid.

On this point, it is clear that the postulations made by the writer were not a fair analysis of the provisions of said section and should be disregarded.

Legislative Cronyism Hiding in Plain Sight?

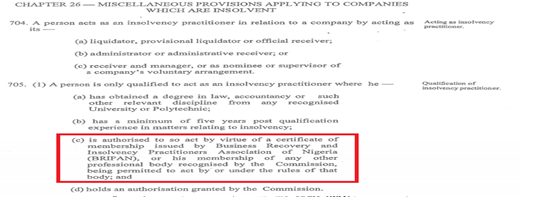

It does look a little suspicious that the name of an APC stakeholder has been linked to BRIPAN. But put political affiliations aside for a minute and think about this: Insolvency practice as referred to in the section above is not the same as the practice of insolvency law. I’ll explain that. An insolvency practitioner (despite the use of the word “practitioner”) refers to only three classes of people as listed in Section 704 above; all of which are similar to the position of receiver/manager under winding up procedures.

Thus, the limitations placed on being an insolvency practitioner are placed on persons qualified to be appointed as “receiver/manager” in corporate insolvency procedures. Where a legal cause of action arises in the cause of an insolvency practitioner doing his job, any lawyer can approach a court. These restrictions do not apply to lawyers appearing in Court; rather, to lawyers, accountants or such other people being appointed insolvency practitioner. This is not an attempt to limit legal practice. Despite the use of the word “practitioner”, it does not refer to a lawyer in practice related to insolvency. So while referring to an insolvency practitioner under the Act, we are referring only to those listed in Section 704.

Furthermore, the practice of requiring certification before qualification to operate in such special/technical procedures is not new to the Nigerian law or even to CAMA. Under CAMA, persons qualified to be appointed company secretary include a legal practitioner, a chartered accountant, a chartered secretary, etc. These require certification from different bodies such as ICAN, ICSAN, etc.

My research showed that there aren’t many insolvency practitioners’ organizations in Nigeria. In fact, my research turned up only BRIPAN formerly known as IPAN (there are probably more but I didn’t see them). So it comes as no surprise that a person seeking to be an insolvency practitioner requires a certification from them. Also, please note that BRIPAN is a non-profit organization which means that the founders and guarantors do not make or split profit. All income is directed towards the purposes for which the company was incorporated.

Section 705 also provides for certification from other similar organizations recognized by the CAC. Where you want to be an insolvency practitioner and you already have a certification similar to that which would be issued by BRIPAN, all you have to do is to approach the CAC and get authorization to work in that field.

Again, in my opinion, the issue of political links was thrown in here to elicit a reaction, not to the insertion of any of the above discussed clauses, but to the political party and the conspiracy theory.

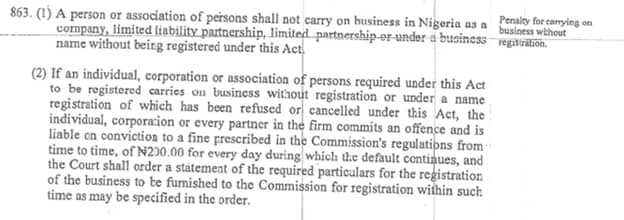

Criminalising the Informal Sector – 21,000,000 Nigerians are now Criminals?

The headline of this part of the writer’s articles is phrased in the most dramatic manner. But in truth, CAMA by specifying that all businesses be registered, is just doing its job. The CAC is to businesses as the Independent National Populations Commission which is responsible for conducting a census is to the Nigerian people. By specifying that all companies and businesses must be registered, they are just doing their job! This is not an attempt to trap anybody; indeed, it may not be the most pressing need Nigeria has. But it is a step in the right direction.

The provision that permits the commission to prescribe a fine from time to time, also goes further to specify the fine of N200.00 daily. It is not a new thing leave prescription of fines to be provided by regulations. Also note that the CAC regulations form part of CAMa.

The writer’s claim that the CAC can now rely upon this provision to garnish accounts at will is laughable. The section clearly states that the penalty shall be applicable “upon conviction”. The CAC must go to Court where both parties must state their case and be heard and the Court will then make a decision. It is not the CAC’s prerogative. Maybe this Act is not as draconian as you initially thought?

The CAC is Now Above the Law – Literally

Let me tell you about pre-action notices. Preaction notices come into play where a law provides that certain notice must be given to a certain person before a valid action can be instituted against them. Requirements for 30 days preaction notices similar to the one above are in nearly every law regulating a major governmental organization. CBN, AMCON, Customs, Immigration, Nafdac, etc. require 30 days notices. The idea behind this requirement is to create an avenue for settlement and to anticipate the bureaucracy. Where a preaction notice is served, more often than not, the agency served responds sometimes with an olive branch.

Also, we all know how extensive Nigerian bureaucracy can be. You write your letter, deliver it probably at the reception and it does the whole journey to the head who then sends it to the legal department. The legal department then knows to look out for your processes and to act upon it within the specified time.

Preaction notices are not unknown to the Nigerian legal system. They are a recognized prerequisite to the jurisdiction of the Court and without service of the adequate preaction notice, the Court will not hear your matter. They couldn’t even if they wanted to. Preaction notices are not a contravention of your right to fair hearing. They are simply a requirement for the full exercise of that right where the law requires it.

The requirement for preaction notice is not an attempt by the APC ruled government to take away any rights of the Nigerian citizen. It is a common sense provision because believing anything to the contrary would mean that all the other laws signed by different other parties which provide for preaction notices were all a conspiracy against us.

Bonus Clause: All Foreign Companies Must Register. Except Chinese Ones.

The reference to the Chinese in this section by the writer serves the same purpose as a lot of information and choice of words used in the article: Drama. Reading through the Sections quoted above, note the following things: first, there is no reference to any Chinese companies, generally or specifically. Second, the provisions of this Section (as amended) are fundamentally identical to the provisions of CAMA C20, 2004. The only major difference is the provision that the CAC now prescribes penalties by their regulations.

Reading through all the provisions of CAMA, 2020 relating to foreign companies specifically Sections 78 – 84, there is no provision exempting China from registration of their foreign businesses. This begs the question “what point was the writer trying to make?”

I do not presume to understand the workings of the writer’s mind, but here’s an assumption. If the writer was referring to Section 78(3)(b) which exempts foreign companies which are exempted under any treaty to which Nigeria is a party from registration of their businesses. I would like to point out here, that this provision is in the old CAMA which existed long before this regime. Thus, the insertion of this clause is not part of a grand plot to “sell Nigeria’s sovereignty” to China. Rather, it is simply a regular provision designed to display our good will to countries with which we have related treaties. Besides, Nigeria has bilateral investment agreements with 31 countries, 15 of which are currently in force. We also have double-tax treaties with 13 countries, and are signatories to 21 investment-related instruments and nine memorandum of understanding agreements (For more information, visit <www.ukpracticallaw.thomsonreuters.com>).

In the event that the writer was referring to the classifications of foreign companies not requiring registration stated under Section 80, the same principle as explained above also applies. The provision existed in the old CAMA and is designed to encourage foreign investment. The provision does not apply to only Chinese companies. It applies to companies from every foreign company falling under any of the categories contained in that section.

Conclusion

With the above, I have painted a clearer picture of the relevant Sections with an intent to correct the misinterpretations thereon. The Companies and Allied Matter Act, 2020 is a good legislation. It provides a better and more applicable companies regulations regime that suit the computer age. It provides innovations like the recognition of virtual annual general meetings, provides for insolvency practice as an alternative to winding up, new business structures called the Limited Liability Partnerships (LLPs) and Limited Partnerships (LPs) to better provide options for businesses not interested in registration as a company, and so much more.

Please, take some time and read our article available at https://pathsolicitors.com/the-companies-and-allied-matters-act-cama-2020-at-a-glance/ or click here to see the innovations introduced by the new CAMA, 2020.